Created on Tuesday, 24 April 2012 10:10

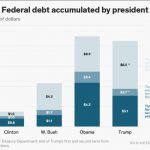

The sovereign debt levels around the globe are unprecedented for countries in peacetime. The odds of more restructurings (like the recent one in Greece) and/or defaults are higher than most believe. So the 64 trillion dollar question is ‘when does debt become unsustainable’? This video explains how and why the debt levels of numerous countries have reached disastrous levels. Since the bill coming due in the form of maturing bonds is so large, policymakers in Europe have no easy way out. "Solutions" may include printing money to create inflation or debt restructurings/defaults or a combination of the two.

In this presentation (dated 18 December 2011) Chris Ciovacco of Ciovacco Capital Management compares healthy markets to the current state of affairs. Which investments tend to perform well during deflation/defaults/restructurings? Which investments tend to perform well during periods of inflation/money printing by central banks? And also, what is a ‘back-door bazooka’?

No Comments