Chapter 3: The Basics of Banking & Business

Last updated: July 19, 2020 at 18:03 pm

3.1 The Money Masters

The Money Masters (1995) discusses the topics of money, debt, taxes and their development throughout the modern world. It criticizes the control aspects of modern centralized banking systems and regulation. The film uses as evidence the history of money and banking, showing the viewer how central banks came to be what they are today and how they operate.

It supports its assertions by references and quotations from past Presidents and major players in the banking industry. The documentary was released in 1995 and the film still has considerable popularity, gaining interest from an audience first introduced to this subject through other documentaries such as Zeitgeist.

“The powers of financial capitalism had a far-reaching plan, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole…

Their secret is that they have annexed from governments, monarchies, and republics the power to create the world’s money…”.

– Prof. Carroll Quigley renowned, late Georgetown macro-historian

3.2 Money, Banking and The Federal Reserve

Thomas Jefferson and Andrew Jackson understood "The Monster" but to most Americans today, 'Federal Reserve' is just a name on the dollar bill. They have no idea of what the central bank does to the economy, to their own economic lives, how and why it was founded and operates, or of the sound money and banking that could end the statism, inflation and business cycles that the Fed generates.

3.3 Money, The Federal Reserve and You

In this video Gary Fielder, a criminal and constitutional lawyer from Denver, presents ‘The Gig Is Up: Money, the Federal Reserve and You’ at The University of Colorado School of Law on December 4th, 2008. Fielder gives a historical analysis of our current banking system and the creation of money.

With quotes from Ben Franklin, Thomas Jefferson, Abe Lincoln, Ron Paul, Dennis Kucinich and many others, he makes his case to abolish the Federal Reserve and return to a sound and honest money system.

3.4 Money as Debt I

Paul Grignon's 47-minute animated presentation explains in very simple terms what money is and how it is created.

You can watch Part II and III in this series on this link.

3.5 I.O.U.S.A – One Nation, Under Debt

(I posted this article in September 2009 and it was last updated in October 2013. The U.S. National Debt is currently (June 2020), approx. $26 Trillion)

Posted in 2009 and 2013: As the United States is once again very close to breaching their debt ceiling I decided to put this documentary, which outlines the history of the US national debt up to the end of the Bush era, on the front page. The documentary was released in 2008 and therefore it does not cover the enormous spending of the Obama Administration, which is borrowing far more money every year than the highest spending years of the Bush administration. If you want to have a better understanding of why the United States is now (October 2013) in the financial state that it’s in, I recommend that you watch this film. The US government is currently funded until January 15th, 2014 and the debt ceiling will need to be raised AGAIN before February 7th, 2014 to avoid a breach and default on the US national debt. For more on the government shutdown vs the debt ceiling I would like to refer you to this article.

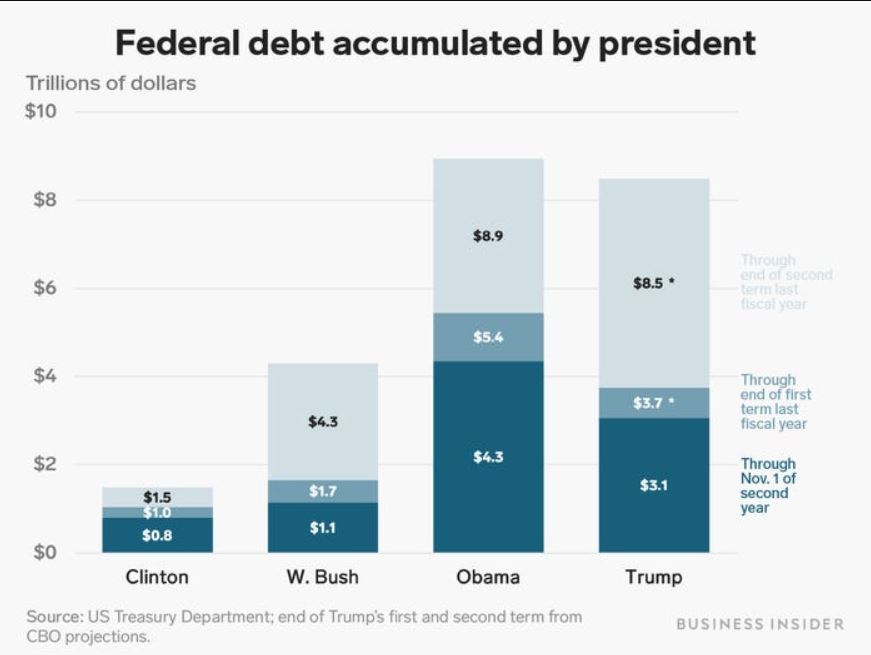

Update 19 July, 2020: Recommended reading (article posted on businessinsider.com on November 25th, 2019): The national debt just barreled past $23 trillion. Here's how Trump's $3 trillion portion compares to Obama, Bush and Clinton.

The article ends with two statements from Marc Goldwein, the policy chief of the Committee for a Responsible Federal Budget, which I think are absurd.

Goldwein said that while the debt could lead to "slower economic growth" in the "medium or long term," it doesn't damage the economy as much in the short term.

"Just by the virtue of the fact that interest rates are lower, it's certainly true that each dollar of debt is less than a threat than we thought eight years ago," he said.

"While the debt could lead to "slower economic growth" in the "medium or long term," it doesn't damage the economy as much in the short term, and each dollar of debt is less than a threat than we thought eight years ago?" Really? You'd have to be delusional to believe that, even pre -"COVID-19".

If Trump really is "a man of the people" as he pretends to be, he should spend less time on Twitter and more time on taking actions that actually have an impact on the issues that I already mentioned in this article, COVID-19, CHIMERICA and The Dollar Bubble.

Getting the U.S. out of the insane "COVID-19" lockdown and measures and thereby setting an example for the rest of the world, as the U.S. so often does (for better or for worse I might add), would be a way to start.

3.6 The Dollar Bubble

‘The Dollar Bubble’ is a 30 minute documentary about the upcoming collapse of the U.S. dollar and how the Federal Reserve's destructive monetary policies will bring the U.S. and global financial system to an end. It features Peter Schiff, Ron Paul, Marc Faber, Gerald Celente, Jim Rogers and others.

The topics that are covered include the U.S. National Debt, deficit spending, inflation, precious metals, agriculture, real estate, health care, education, foreign currencies, cash for clunkers and more.

3.7 Meltdown – The Global Financial Crisis of 2008

In 2008 greed and recklessness by the titans of Wall Street, years of deregulation by the US government and faulty ratings from credit agencies triggered the biggest financial crash since The Great Depression.

In this 4 part documentary series produced by the Canadian Broadcasting Corporation (CBC), Terence McKenna takes viewers behind the headlines and into the back rooms of world governments and financial institutions, in an attempt to explain the events and decisions that led to the 2008 meltdown.

If you think that politicians and financial institutions have now learned their lesson and the crash of 2008 will not repeat itself – think again.

Part 1: The Men Who Crashed The World

Part 2: A Global Tsunami

Part 3: Paying The Price

Part 4: After The Fall

3.8 Four Horsemen

This documentary has nothing to do with the biblical concept of the Four Horsemen. It identifies the modern day Four Horsemen as:

1) A rapacious financial system

2) Escalating organized violence

3) Abject poverty for billions

4) The exhaustion of the earth's resources

In this film various economists, former government advisors, former Wall Street insiders and a host of other speakers, explain the mechanics of the current global financial and economic system and the enormous imbalance that it creates. I don’t agree with the solutions that are offered as a remedy by some of the speakers, but the overall content is highly informative.

As always I recommend that you draw your own conclusions.

3.9 The Ascent of Money – "Chimerica"

This episode of the Ascent of Money explains the symbiotic relationship between The United States and China, which is one that these countries cannot disengage from without a major conflict, a major economic collapse – or both.

3.10 The Corporation

‘The Corporation’ is an award winning 2003 Canadian documentary about the modern corporation. Its main thesis is that the modern business world will do anything, regardless of morality, to make money.

The film examines the nature, evolution, impact and future of the modern business corporation and the increasing role it plays in society and our everyday lives.

3.11 ENRON, The Smartest Guys In The Room

Enron went from being the seventh largest US company to bankruptcy in less than a year and this is the story of the downfall. All major players are put under a magnifying glass – Ken Lay (with Falwellesque rectitude), Jeff Skilling (he of big ideas), Lou Pai (gone with $250 M) and Andy Fastow (the dark prince).

Along the way we watch Enron game California's deregulated electricity market, get a free pass from Arthur Andersen (which okays the dubious mark-to-market accounting), use greed to manipulate banks and brokerages (Merrill Lynch fires the analyst who questions Enron's rise) and we hear from both former Presidents Bush "what great guys they are".

3.12 We're Not Broke (2012)

By now it is (or should be) a well known fact that the United States is nearing societal and economic collapse. Lawmakers cry “we’re broke” as they slash budgets and leave many Americans scrambling to survive.

Meanwhile, multibillion-dollar American corporations like Exxon, Google and Bank of America are making record profits. While the deficit climbs and the cuts go deeper, corporations with intimate ties to political leaders are concealing colossal profits overseas to avoid paying U.S. income tax.

‘We’re not broke’ is the story of how fed-up Americans from across the country take their frustration to the streets and vow to make the corporations pay their fair share.

3.13 The Fools On The Hill

Disgusted with the corruption and legislative malpractice, average-Joe-citizen Jerrol LeBaron set out on a quest to get legislation passed that would force legislators, at both the state and federal level, to read and fully understand any piece of legislation before voting "yes" on it and to make the final text of the bill available for public perusal online prior to the vote.

This seems to be a common sense requirement that would get broad support across the political spectrum, but Fools On The Hill shows just how entrenched the interests opposed to such a measure are, and how difficult it would be to actually get that kind of legislation passed.

3.14 Fishead: Are Political And Corporate Leaders Psychopaths?

A fish rots from the head down. – Chinese proverb

Who, or what, is a psychopath? Unlike Hollywood’s stereotypical image they are not always blood-thirsty monsters from slasher movies.

The medical definition is simple: A psychopath is a person who lacks empathy and conscience, the qualities that guide sane human beings when they have to choose between good and evil, moral and immoral. Most of us are conditioned to do good things. Psychopaths are not. Their impact on society is staggering, yet altogether psychopaths barely make up one percent of the population.

Through interviews with renowned psychologist Professor Philip Zimbardo, leading expert on psychopathy Professor Robert Hare, former President of Czech Republic and playwright Vaclav Havel, authors Gary Greenberg and Christopher Lane, professor Nicholas Christakis, among numerous other thinkers, this film delves into the world of psychopaths and heroes and reveals shocking implications for us and our society.